TheMissionary wrote:mookiemcgee wrote:Coins I expect to have exceptional runs when the next parabola starts, they all have had/are having big runs around ETF news so don't go out an buy anything today you regards:

SNX - Synthetix lower volitility than most, established player that is evolving into critical infrastructure. Currently focused on expanding on Optimistic Rollup chains (like OP, and coinbases new chain called Base)

ARB and OP - Arbitrum and Optimism - These are the two most prominant Ethereum Layer 2's and while tons of new L2s are launching in 2024 these are established players with very large TVLs. Optimism already had an initial pump in 2022/23 so may be a bit of a laggared, but has the coolest tech and smartest builders. Tokenomics do leave something to be desired and not sufficiently decentralized (VC's own too much) but is very well positioned. Arbitrum is by far the most decentralized L2 with the most users and largest amount of Devs building on it. The coin hasn't been arounds as long as OP and has yet to really have a 'season'. I expect ARB to have some of the best ROI of any large cap crypto over the next few years.

Solana - I don't love Solana, and it's a pure VC coin with an already marred by Sam Bankman history... but it's really cheap to use, really fast and has pumped more than anything over the last few months (some of that is deposits going into the grayscale SOL fund). It's also non-EVM (it doesn't work like Ethereum as a technology it's entirely different in how it validates transactions). It has a massive core of users as well as active developers. Next to Ethereum it's the biggest most important blockchain that runs smart contracts. I'm personally not a true believer but history suggests I'm wrong and it's worth keeping an eye on.

STX - stacks - the 'best' attempt so far at having smart contracts that settle on the bitcoin blockchain. It doesn't work great yet, and it has alot of competitiors but you can view it as a leveraged bet on Bitcoin price (if bitcoin 2x's, Stacks will like 3-6x over the same period).

AVAX - Avalanche - Is EVM, but works differently from Ethereum. It's working hard to position itself as the premier chain for 'gaming'. gamefi is a crowded catagory and it has alot of competitors. It's well positioned for when gaming stuff has a big run, and has a higher floor than alot of smaller gaming focused chains.

There are tons of other smaller caps I'm keeping an eye on, but of like 'top 50 fully diluted value coins' these are some of my top picks.

What are your thoughts on ADA(created by the creator of ETH)?

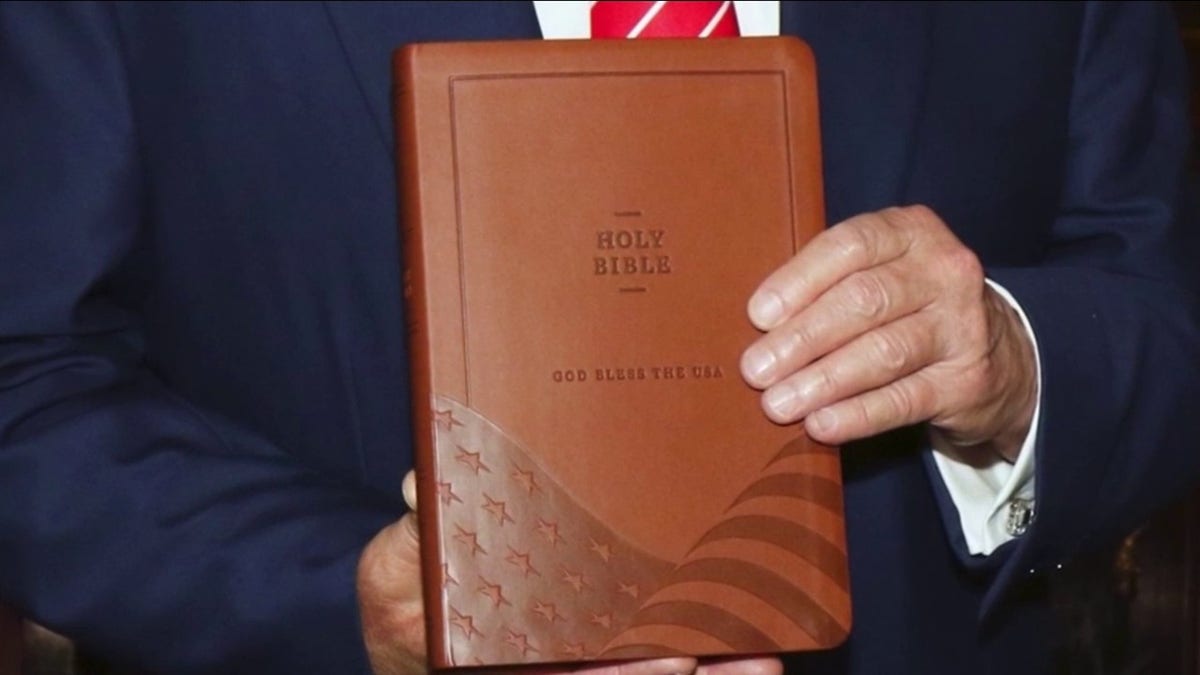

Charles Hoskinson is a co-founder of ETH, but i'd hardly call him the creator. Generally that title is given to this man

Vitalik 'Big Dick" Buterin, he's a Canadian citizen of Russian decent.

Charles Hoskinson project Cardano (ADA) is one Saxi has asked about many times in this thread (and maybe older crypto threads I've started over the last 4 years?). Charles is legit brilliant, ADA is a super real project that was purposely built differently than ETH for the ground up. That said, ETH started in 2016 and launched immediately with smart contracts and while clunky those first few years it never 'broke down'. Cardano started back in 2017 and made some promises about being able to do what ETH could do but better after a few more years of development. They tried launching smart contracts during the last bull run in 2020/21/22 and it didn't work well at all. People would submit a 'trade' transaction on an on-chain exchange and would be waiting 3-4 days for it to go through. Alot of the ADA maxi's I knew really started having a crisis of confidence around then and the price got up pretty high around $2-3 right in the leadup to them trying to launch these smart contracts and really haven't stopped going down after than for like 2 years since (until the last few months but everything is rallying like crazy and its lagging a bit)

So yeah idk, it's not a dead project or anything. Tons of people are working on it still, but it had alot of issues with throughput because of some technical structural issue where it processes transaction super fast but only one at a time (one transaction per block) and the first go round wasn't ideal. During that same 20/21 time period another Ethereum challenger SOL (solana) really took off and was faster, cheaper and actually handled the load in real time. Alot of chains built off the underpinnings of ETH but built to be seperate chains like BNB (binance chain coin), AVAX (avalanche), MATIC (polygon) went live and all rockets up in 20/21 so there was alot of stuff working well and people were trying to do different things and idk Cardano could make progress and make a big comeback but so much stuff has flourished and ADA just feels a big stagnate. It's worked about as well as smart contracts built off Bitcoin so far. If bought a pile at just under $3 *cough saxi* you could get your money back or more if everything just rockets up in price ADA will go with it. Id rather just be directly 100% in ETH than be 100% in Cardano